Jerry Polinsky tries his luck in Atlantic City

Related to Minnesota Woolen Mills posts on Perfect Duluth Day is this December 1978 Corporate Report article.

Jerry Polinsky Tries His Luck in Atlantic City

Considered ‘insolvent’ in Duluth, the former Minnesota Woolens executive is laying heavy bets along the Boardwalk …

By Charles I. Mundale

In early summer 1977, a new hotel corporation was formed in Atlantic City, N.J.

In late summer 1977, an old retailing company bellied up in Duluth, Minn.

Regency Hotel Corp. had been formed to sell limited partnerships in a hotel-casino proposed for Atlantic City’s burgeoning, newly legal gambling industry. Ultimate investment in the project, it was predicted, would be $45 million. Jerrold Polinsky was president.

Minnesota Woolens, Inc., had been founded in 1916 and had, in more than a half century of operations, extended its direct-sales activities over most of the country. When it folded, its debts totaled $5.6 million. Jerrold Polinsky was chairman of the board.

Basically, then, this is a story that asks the question, How can a man be broke in one state and a multimillion-dollar wheeler-dealer in another?

A conundrum? A paradox? An impossibility? So it would seem. Perhaps the question is not quite rightly put — though many are asking it in just that way. Perhaps the question should read, How can Jerrold Polinsky be considered broke in Duluth and, at the same time, be taken seriously as a man of ways and means in Atlantic City?

An answer to that would at least seem possible and scarcely less interesting, so Corporate Report has tried to find it. In the process a great many related, fascinating and unexpected questions turned up?

Why did Minnesota Woolen, so long successful, go down the tube while its two major competitors, selling essentially the same kinds of merchandise with the same sales techniques, stayed alive and prosperous?

Was there a power struggle between Jerrold and his brother, Richard, over control of the company?

Were company funds drained away at the gambling tables in Las Vegas?

Why has Minnesota Woolens never filed bankruptcy?

Why didn’t creditors force a bankruptcy?

Is $500,000 a fair price for Jerrold’s share of the cable television company for which he secured franchises in Duluth and in Superior, Wis.?

Is Jerrold using his own funds in Atlantic City or is he only representing others? If there are others, who are they?

What is the nature of Jerrold’s relationship with Robert Guccione of Penthouse magazine and Rocky Aoki of the Benihana of Tokyo restaurant chain?

Amidst these and other questions, Jerrold Polinsky remains a mystery, a man watched for and talked about but seldom seen. “If he’s in town 20 minutes, I hear about it,” remarked one ex-employee of Minnesota Woolens who now works in downtown Duluth. “People come in here and say, ‘Guess who’s in town’ and I know who they mean.” In Atlantic City, state and local officials, newspaper reporters and court officials all recognize the name of “the Minnesota businessman” who has been making news in their city for more than a year, but then they add, “I never saw the man.”

Early last summer, Polinsky accepted phone calls from Corporate Report and promised cooperation “in a month” or “later,” but in late August he said he had made arrangements to tell his story to another publishing firm — Penthouse? — and could say no more. A month later in Duluth, in his only — and brief — face-to-face conversation with Corporate Report, he said he did not want to talk. “Minnesota Woolens isn’t news, and we’re not going to talk to you,” he declared, implying with the plural that he spoke for his brother, Richard, who was with him. “Where were you when things were going great? New Jersey is news,” he continued, “but I’m under contract for a book, and I am not going to tell you anything.”

That seemed clear enough. So we set out to find the answers on our own, realizing, of course, that no answer can be considered final until Jerrold Polinsky himself has responded.

Jerrold and Richard Polinsky took control of Minnesota Woolens in 1964. Three years earlier the company had effected a major expansion when it purchased a six-story building next to the five-story structure it had occupied for 27 years at 21 W. Superior St. in downtown Duluth. A gala grand opening had been staged in April 1962, and, in 1964, the firm had exhibited its wares at the New York World’s Fair. The future looked promising, and it seemed to make good on those promises through the early ’70s.

Under the brothers’ leadership, the company’s sales strategy was changed in two significant ways. The old door-to-door, one-on-one approach was replaced by the party method, and the crew of mostly full-time sales people was vastly enlarged by heavy recruitment of part-timers. The result was a huge increase in the number of persons being contacted by Minnesota Woolens representatives. By the end of the decade, more than 5,000 people were out there selling.

The party plan not only changed the nature of the sales force, however, it also changed the nature of the product line. According to a former company officer, the quality merchandise sold in the one-on-one situations gave way to a wider price range better suited to the party setting. “Seventy-five percent of our volume was women’s clothes and stuff that women buy for men,” the former employee explains.

In July of 1970, the company announced another expansion and moved into additional quarters at 737 E. Superior St. Jerrold, as chairman of the board, cited “substantial growth” in sales and sales personnel over the previous three years. Fourteen months later, the firm applied for a building permit for a new $200,000 manufacturing facility at 4219 W. Superior St. Jerrold and Richard revealed long-range plans for a $2.5-million complex in West Duluth that would put the company’s four operating divisions under one roof. The 24,000-square-foot first phase opened in June 1972. A second phase, with $84,000 square feet and costing about $1 million, was scheduled for occupancy by November 1973. In May [print obscured here] Richard announced plans to remodel the company’s retail store at 21 W. Superior St. and renamed it the Fashion Wagon.

That was the last of the good news.

In March 1976, the company announced that MMC, Inc., a wholly owned manufacturing subsidiary, would be phased out. Thomas Miller, a senior vice president, explained that the factory, which had begun as a sewing operation in 1948, simply could not compete with it bigger rivals. Competition from the Orient was also a growing problem. Harry Dack, who, like Miller, was a longtime Minnesota Woolens employee, had been CEO at MMC and was to be reassigned with the company.

The cutback constituted public acknowledgement of rumors that had been circulating in Duluth for many months. Minnesota Woolens was in trouble. It followed by only two months what one former sales representative terms a “terrible” national sales convention in Las Vegas, Nev. “Things had been bad before that,” the ex-employee recalls, “but after that things went really bad.”

The handwriting had been kept off the wall for about two years. A former company officer remembers the fall of 1973 as particularly disastrous. That was the fall of the Arab oil embargo, and what was supposed to be the year’s peak selling period became, instead, a deep and unexpected valley. The faucet just shut off,” the ex-insider relates, “and left us with a huge inventory. And a clothing inventory is about like an inventory of yesterday’s newspapers.”

Not surprisingly, there are several versions of the decline and fall of the Polinsky empire. Some are not only predictable but predictably simple. They are neatly and sometimes hostilely encapsulated in comments like, “They [meaning the two brothers] milked the company;” or “The company was frittered away in gambling and high living.” Such intemperate assessments, however, tend to come from the periphery or, if from the inside, from persons whose wounds have not yet healed.

On the other hand, a generally coherent account of the events and business practices which led to the demise of Minnesota Woolens has emerged from conversations with former high-ranking company officials. Some of those interviewed worked at the Duluth headquarters and others were area supervisors with the company’s far-flung sales force. As already suggested, emotions apparent in their responses covered the spectrum from sad to disillusioned to bitter. Yet, on the basic question, “What went wrong?” there is unanimous agreement:

Minnesota Woolens began losing its customers because it failed to deliver its merchandise. When this occurred, sales people became frustrated and discouraged, and turnover increased dramatically. Preoccupied with the need for continual recruitment, area supervisors saw their energies drain away and their income dwindle.

“We weren’t servicing the customers as well as we had in the past,” explained one former supervisor, “and they would become disenchanted with us. This, in turn, would rub off onto the sales people.” Another describes the delivery problem as “horrible.” “We didn’t know how bad it was, because we became part of it. We became part of making the excuses.”

According to the ex-supervisors, unfilled and partially filled orders were typically accompanied by credit slips, which became a source of disappointment and embarrassment. “The credit certificates were astronomical,” reports one person. “I mean it’s just unbelievable.” The company made good on them if people sent them back and asked for a refund, but this took more time and bother. Furthermore, the ex-employee explains, “it’s a turnover business. People come and go. You have a $7 credit certificate because something didn’t come, right? Well, the housewife puts it in a drawer. She loses it. When she thinks about it six months later, the girl who sold it to her has quit the business. [The customer] says, ‘Oh, forget it.’ If you have a thousand people doing that, that’s $7,000 you have made for nothing. There was no backup person who would say, ‘Hey, I’ve got to go see this customer, because she’s got a credit certificate.'”

A former insider confirms the ex-supervisor’s description, and adds that toward the end shipments went out with as little as 50 or 60 percent of what had been ordered. Faced with repeated delays, sales people frequently tried to keep their customer’s good will by refunding money themselves.

According to the ex-insider, “thousands of dollars” in credit certificates were floating at any given time. Meanwhile, the problem was worsening on the supply side, because suppliers were demanding payment before they would ship. “I used to go to New York quite often,” relates another former headquarters official. “Those companies really rolled out the red carpet for us.” All that changed, however, as the company’s difficulties became apparent to its suppliers. “The same companies would say they couldn’t ship unless they saw a financial sheet. I just told them to see Richard or Jerry, but I know they never saw any financial sheets. That was strictly a family matter.”

And financial sheets, it seems, were not the only “family matter” in the closely held family corporation. Behind the question about what was happening in the last years is another question: Why did it happen? The answer to that is tied to the company’s decision-making pattern. According to their former employees, Jerrold and Richard made the companies decisions, and about six or seven years ago they made a costly mistake and got the company overstocked on merchandise that wouldn’t sell. “There were some design and buying errors, frankly,” says one former regional supervisor. “When the trends shifted a little bit, they didn’t shift with them. … The staff wasn’t correct for the mood of the times, and it was also poor quality.”

A Boston-based discount firm offered to take the over-supply at about 50 cents on the dollar, former employees recall, but one or both of the Polinsky brothers chose not to accept the offer. “As a result,” says one person, “that capital was tied up and not working for them.”

The leftover inventory, according to a source from inside, was “huge,” so the capital tie-up was a serious one. It might have been handled better, however, and the ensuing juggling with suppliers and customers might have been avoided or at least foreshortened, say informants, had it not been for another factor in the company’s decision-making procedures: sibling rivalry. A former supervisor says he was first convinced of this problem about three years ago, but an ex-insider says the power struggle had been going on for years.

Jerrold and Richard Polinsky had cast themselves in essentially complementary roles at Minnesota Woolens. Jerrold was the merchandiser, responsible for selecting and acquiring the product lines and for publication of the company catalog. Richard was the marketing specialist and worked with the sales force. Jerrold was chairman of the board; Richard was president. Insiders report, however, that this formal, and seemingly neat, division of duties, masked a running disagreement over the affairs of the company. One person says Richard became deeply discouraged at one point. The company was doing badly, and he was going through a painful divorce. “For a while he didn’t want any part of the business,” the source recalls.

Jerrold assumed greater control, and serious efforts were made to get the company moving again. One former sales supervisor remembers one of those efforts: “We had a meeting with the executive [external] vice president and some internal vice presidents. They [the Polinskys] were being very honest at this particular meeting, and they asked at eight o’clock in the morning, “What’s the matter?”

“I’m very frank about things, and I said, ‘If you two would get over your sibling rivalry maybe we could get on with something,’ and the shit hit the fan. … It was a tremendous outburst. Jerry was noncommittal. Richard admitted that he was fighting his brother. After that it was all downhill.”

It should be noted that the point at which “everything went downhill” shifts with the perspective of the observer. Similarly, the point at which the downhill slide seemed irreversible was different for different people. One former area supervisor says the onset of declining sales back in 1974 was warning enough, and that person left the company then, despite the 20 years invested. Another hung on into 1976 but left when “I was asked to take a 75-percent pay cut.” Others hung on to the very end: “I really kept thinking it was going to be all right. Dick called me at 10:30 one night and said, ‘We’re finished.’ And I was so upset, because the girl we were doing the party for the next night was one of my managers, and it meant a lot to her, because her husband was laid off at the time, and they had to have the money. How could I tell her? I said, ‘Dick, how can that happen? You kept reassuring us.’ He said, ‘I know, but they locked us out today.’ So that’s when I called and got my other job.”

However one perceives the downhill glide — its beginning or the speed of decent — it was indisputably a time of unremitting strain for the Polinsky brothers and their employees. Before it was “finished,” Jerrold had turned most of his attention to other ventures, and Richard was once again absorbing the brunt of day-to-day battle. Jarrold, in fact, was to claim that his board chairmanship was “honorary” and insist that Minnesota Woolens was his brother’s business.

The company applied for a $3 million low-interest loan from the Economic Development Association on grounds that its profitability had suffered from Taiwanese imports. Since the Polinsky family had been consistent contributors to the Democratic Farmer Labor Party, their plight and the loan application did not go unnoticed in the offices of Sen. Hubert H. Humphrey and Rep. James Oberstar of the Eighth District. As one insider to Duluth politics put it, “They were calling in their markers.” The application was rejected, reviewed, rejected, re-reviewed and rejected a third time. Meanwhile, hopes were kept alive. During the final months, 10 suppliers brought suit for unpaid bills totaling hundreds of thousands of dollars. The First National Bank of Duluth was holding a secured note for $1.3 million.

The company’s last gasp was a merchandise show for sales representatives in the summer of 1977. People were brought in at company expense. “They showed them a line that never was … an invisible thing,” claims a former supervisor, who suggests the event was staged to convince creditors there was still life in the organization.

The long, bruising ride downhill finally reached bottom one day late in August 1977, when Henry Royer, executive vice president of the First National Bank of Duluth got a phone call from the EDA office in Washington. The $3 million loan had been turned down for the third time. “That was it,” Royer recalls. As it turned out, First National was the only secured creditor, so when the foreclosure came, the company simply turned over the assets it had on hand, and the bank began making plans to sell them and try to recover its money from the receipts. The “assets” included merchandise (some of it out-of-date) equipment (much of it old) and property, including two buildings, some vacant lots and the house Richard had been living in.

There was no bankruptcy. Any two creditors could have forced it. Royer speculates that other concluded there was little point in it. “They probably could not have recovered their legal fees,” he says. “Actually the bank could have saved money in legal fees if someone had forced a bankruptcy,” Royer laments. “Doing it this way, we had to have our lawyers making sure we were disposing of the assets in a ‘commercially reasonable way.’ We didn’t want one of the unsecured creditors coming into court and charging we had not done it correctly and risk getting our efforts set aside.”

Royers says the bank had been “fully aware” of the company’s financial straits and probably would have moved sooner had it not been for two considerations: the Polinsky family’s long record of contribution to the community and the pending EDA application. “The EDA certification in January [1977] was worthless,” Royer says. “They could have saved us time, trouble and money if they had acted sooner.”

In October 1977, the state of Minnesota sued Minnesota Woolens for $98,663 in unpaid withholding taxes and penalties. In 1978, the federal government has filed tax liens of $24857 against Minnesota Woolens and a total of $185,276 against members of the Polinsky family. (Of the latter, releases have been filed for $10,446.)

When the bank moved in, no one knew for sure just how the financial mess would shake out, and it took some time to sort out the “debris.” Royer, the man who did the sorting, told Corporate Report recently that, as of Jan. 31, 1977, the company’s debts totaled $5,644,000. The final line in this “very sad, sad story,” as one ex-employee described it, was a negative worth of about $3 million. As Royer reluctantly summed it up, “The game was over.”

While the game called Minnesota Woolens, Inc. was over, others certainly were not. Individual lives, after all, had to go on, and, one by one, those who had worked for Minnesota Woolen found new jobs and reoriented their lives. A few stuck around to provide help and advice in the liquidation process. Richard and his second wife, whose father heads a company that was one of Minnesota Woolens’ major suppliers — and creditors — went to work in the fall of 1977 for the Amway Co., another direct-sales firm, but informants are uncertain about the status of the Amway relationship now. Former company officials are unanimous in their assessment of Richard’s sales ability. “He’d be a great asset to any company he worked for,” says one. “Dick has a lot of charisma; he has personality,” says another. Though it may serve him again in the future, personality has not protected him from the past. On November 21, Richard Polinsky filed personal bankruptcy in federal district court in Duluth.

Richard’s deteriorating situation stands in dramatic — perhaps ironic — contrast to that of his brother. As already noted, Jerrold had developed other interests long before the failure of Minnesota Woolens. In fact, while the clothing firm was prospering in the late ’60s, Jerrold was the central figure in extensive negotiations that finally resulted in cable television franchises in both Duluth (July 1968) and in Superior, Wis. (January 1971). For his efforts, Jerrold received 20 percent of the stock in Northeast Minnesota Cable Television Co. The remaining 80 percent was owned by H & B Communications Corp., which was acquired by Teleprompter Corp. of New York in September 1970.

That relationship is now embroiled in a complicated lawsuit in federal district court in Duluth. In the suit, Jerrold is demanding a judgment “in excess of $500,000,” a price, he says, he and Teleprompter agreed upon for his 20 percent of the company. In a countersuit, Teleprompter claims that the stock subscription agreement between that company and Polinsky does not require a payment of $500,000 but rather an amount equal to three times the cash flow of Northeast Cable. (Northeast Cable submits a regular monthly accounting to the city of Duluth which collects five percent of the company’s gross as a fee for the franchise. In 1978, receipts have been running about $34,000 a month.)

Among the documents filed in the suit are a set of interrogatories from Teleprompter and Polinsky’s answers to them. The tenor of the questions strongly suggests that, among other things, Teleprompter may try to establish that $500,000 is too high a price for Polinsky’s efforts. In his answers, Polinsky declares that he spent an average of 10 hours a week from the fall of 1967 through July 1968 on the Duluth franchise and an average of seven hours a week from February 1970 until January 1971 on the Superior franchise.

In the case of the Superior franchise, Polinsky claims a “substantial expenditure of time” was “critical” to the company’s ultimate success because of a “vigorous contest” waged by Superior attorney Toby E. Marcovich, who was representing another company. Marcovich told Corporate Report that the company he represented, a Los Angeles firm, was originally successful but “got into some kind of hassle and was unable to perform. It put us in a hell of an embarrassing position,” he said.

In the Duluth franchise, Polinsky says, his “constant involvement” was crucial. “In particular,” he states in answer to one of Teleprompter’s questions, “the last-minute effort by Jeno Paulucci to delay or prevent the awarding of the franchise to Northeast was only overcome after particularly intensive lobbying efforts [by Polinsky].” Paulucci told Corporate Report he did look into the franchise potential in Duluth “but it was too late and they [Polinsky’s company] got the jump on us.” Other Duluthians involved at the time, however, do not remember any serious bid by Paulucci. Former Mayor Ben Boo does not recall it; Mel Cohen, a radio and television dealer, and Fran Befera, who heads a local television station, both made formal bids for the franchise and concede that Jeno may have been interested — “There must have been quite a few,” Befera observed — but neither has any firm recollection of it. A search of city council minutes reveals no formal application or other inquiry from Paulucci.

Polinsky says he spent between $20,000 and $25,000 of his own funds on the franchise project before the franchises were awarded and an equal amount afterward.

The Teleprompter suit also involves two Duluth banks. Both the Northwestern Bank of Commerce and the First National Bank have filed counterclaims for money they loaned to Polinsky in exchange for his rights under the stock subscription agreement. According to the First National Bank, Polinsky used his rights to secure a $225,000 loan. Later, Polinsky used the same security to acquire $200,000 from Northwestern Bank of Commerce. Both banks say Polinsky told them he wanted the money to finance cable television franchise efforts in other areas.

Those franchise efforts had originally been pursued in behalf of the Teleprompter subsidiary. When Teleprompter decided in 1971 not to seek further franchises in Minneapolis, Polinsky went ahead on his own. He had filed an application in Bloomington for Teleprompter and ultimately secured a franchise in St. Louis Park in 1975 for his own Spectrum Communications Co. The franchise had originally been awarded to Warner Communications Co., but the firm “ran into difficulties,” according to a St. Louis Park city official, and sold out to Polinsky. Polinsky later changed the name of his company to Jerrold Polinsky, Inc., and on Oct. 4, 1978, he sold the operation to Northern Cablevision, a subsidiary of the Miami, Fla.-based Storer Communications Co., which had just recently obtained the Bloomington franchise.

In its claim filed in the Teleprompter case, the Northwestern Bank of Commerce says it relied on Teleprompter to alert it to the earlier encumbrances and now brings its claim, because the note is in default “and upon information and belief that Polinsky is insolvent.”

The bank’s statement would raise few eyebrows in light of all that has happened to Minnesota Woolens, but it does seem more than a little anomalous — downright curious, in fact — in view of Jerrold’s recent activities in Atlantic City, N.J. Here, then is the piece de resistance in this “very sad, sad story.” A hometown bank considers Jerrold Polinsky “insolvent” and certainly fellow Duluthians wonder how — with his family business in ruins — he can be anything but broke. Yet, 2,000 miles away Jerrold Polinsky is a central figure in a multimillion-dollar deal.

Atlantic City, whose streets and famous Boardwalk along the Atlantic shore inspired the names on the Parker Bros.’ famous Monopoly board, has recently turned that Depression-born parlor game into real life. The assumptions and the stakes are virtually the same. It pays off handsomely in the game to acquire several pieces of contiguous property and then put hotels on them. Exactly the same is true in real-life Atlantic City. Some locations on the game board are worth more than others. That, too, is true in Atlantic City.

You see, New Jersey voters decided in 1976 to allow gambling in their state but only in Atlantic City. Moreover, the rules of the New Jersey game require that anyone operating a casino must attach it to a hotel of no fewer than 500 rooms. Since Atlantic City is an island, squeezed between an ocean and on one side and thousands of acres of marshland on the other, the amount of land available there is stringently finite. Since Atlantic City is an aging sea resort, it is cluttered with huge old hotels and hundreds of “tourist homes,” Ma-‘n’-Pa motels and picturesque little hostelries with big front porches. Like hens towering over their chicks, the grand old hotels loom above their tiny wooden competitors.

By now the picture should be clear: acquiring land in Atlantic City is an extremely attractive prospect but an exceedingly difficult achievement. So, as one longtime resident put it, “the scramble is on.”

Resorts International, a huge Florida-based conglomerate that had run gambling casinos in the Bahamas and elsewhere, got the jump on everyone, bought the old Chalfonte-Haddon Hall, one of the few old giants considered salvageable, and opened for business last spring. Its half-million-dollar daily take has been an inspiration to its imitators.

Among the inspired is Jerrold Polinsky, whose interest in Atlantic City has at least two explanations. First, he has a longtime fascination for the gaming tables and has been a frequent visitor to those in Nevada. (The Duluth Herald reported a year ago that Polinsky was one of 30 Minnesota residents who had run up gambling debts at the Tropicana casino in Las Vegas in 1974 and 1975. Neveda authorities said they had checked on the Tropicana’s list because so many Minnesotans had turned up on it. The casino was owned at that time by Deil Gustafson of Minneapolis, who told Corporate Report he had no recollection of the $9,000 debt attributed to Polinsky. “I assume it was taken care of in the normal course of business,” Gustafson said. One persistent rumor in Duluth is that Jerrold’s gambling created a serious financial drain on Minnesota Woolens, but knowledgeable, longtime insiders, otherwise critical of Jerrold’s role in the company, agree there is “no reason to believe his gambling was responsible for the firm’s failure.)

A second explanation for Polinsky’s interest in Atlantic City is his brother-in-law, Martin Blatt, an attorney with personal roots and important connections in the resort town. (When Polinsky was still trying to turn Minnesota Woolens around back in 1976, he brought in Blatt as a member of the board. The two men are married to sisters.)

Blatt and Polinsky announced their Atlantic City intentions in the summer of 1977 when they formed the Regency Hotel Corp., a general partnership which was going to seek financing for hotel-casino. Polinsky was named president. Other members of the Regency group included Sonny Werblin, former owner of the New York Jets; Jes Marcum of Santa Monica, Cal., a former consultant to Caesar’s Palace in Las Vegas, and Adrian Foley of New York. Werblin withdrew from the group in September 1977, when the governor raised a question of conflict of interest because of Werblin’s membership on the New Jersey Sports and Exhibition Authority. Foley also pulled out.

On Aug. 7, 1977, Polinsky’s group signed a 30-year lease agreement with the owners of the Howard Johnson Regency Hotel and agreed to a schedule of payments totaling $3.5 million by April 1978. The new company set up offices in a suite of rooms at the Howard Johnson Regency and began looking for backers to assume limited partnerships in the venture. The payment schedule was not met, and the hotel owners agreed to several extensions. According to legal documents filed in Atlantic City superior court, a fourth and final extension was agreed to after a meeting in Boca Raton, Fla., attended by Robert Guccione, owner of Penthouse International, which also has a casino-hotel proposal in the works. Guccione and Polinsky’s Regency group allegedly promised they would be ready with the necessary cash sometime between April 10 and May 1.

The new payment deadline was not met either; the Howard Johnson owners entered into negotiations with Caesar’s World; a lease was signed with the Los Angeles firm, the Howard Johnson people pocketed the $1,450,000 which Polinsky’s group had managed to pay up to that point and evicted them from their suite at the hotel. (Regency Hotel Corp. now uses the same address as Martin Blatt’s law firm.)

Polinsky’s group took the Howard Johnson people to court in June to try to stop their deal with Caesar’s World. A dramatic scene ensued in which a lawyer for Rocky Aoki, owner of Benihana of Tokyo, a chain of Japanese restaurants, waved checks totaling $6 million before the judge in an attempt to convince him that Regency was able to deliver then and there on the total price of the lease. Aoki’s $6 million, it was reported, was to acquire 75 percent of Polinsky’s interest and consummate the deal. The judge, however, was unswayed, and Caesar’s World broke ground Sept. 13 on the $30-million casino it intends to attach to the Howard Johnson Regency.

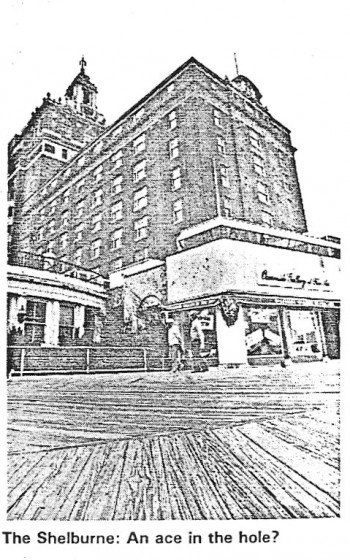

The fight, however, was not over. Though refusing to stop the Caesar’s World project dead in its tracks, Judge Philip Gruccio did agree to hear out Polinsky’s claims, and, had he ultimately ruled in Polinsky’s favor, Caesar’s World would have lost the money it has been pouring into the project. Polinsky’s action, however, was seen as essentially a delaying tactic. In a countersuit against Regency, the Howard Johnson owners charged that Polinsky and his partners were trying to force them into a position where they either had to sever their relations with Caesar’s World or “buy peace … by the payment of a substantial sum of money.” They also charged that Polinsky, Blatt and their partner, John Best, an Atlantic City investment counselor, did not pursue the Howard Johnson project as vigorously as the should have. Instead, it was alleged, they worked on other possibilities, including Penthouse‘s project, the Colony Hotel-Motel and the Shelburne, a 19th century structure on both state and federal architectural registries. The Polinsky group was also charged by the Howard Johnson owners with misuse of funds “and diversion of corporate opportunities.”

In order to clarify the status of the Caesar’s World lease as soon as possible, Judge Gruccio indicated he would rule on that question in the lawsuits first and then take up the other issues, including Polinsky’s demand that the $1,450,000 paid down on the lease and another $800,000 his group claims to have spent on studies, plans and other preparations be repaid. Aoki’s $6 million in checks, meanwhile, was still available to the Howard Johnson group, according to Polinsky’s complaint.

A hearing was scheduled before Judge Gruccio for Monday, Nov. 13, but a settlement was agreed to that day. According to the terms of a four-and-a-half-page document, the Howard Johnson group was to pay Polinsky’s group $1.5 million — $1 million on Nov. 20, another $250,000 on Nov. 15, 1979, and a final $250,000 on Nov. 15, 1980. The Howard Johnson owners further agreed not to interfere with the Polinsky group’s project at the Shelburne. In return, Polinksy’s group agreed not to interfere with either the construction or the licensing efforts of the Howard Johnson / Caesar’s World project.

The Shelburne deal dates from last July when a 30-year, $14-million lease was signed with the hotel’s owners, Gary and Lewis Malamut, members of an old Atlantic City family. Plans call for $30 million to be spent on renovation of the 550-room structure, with completion scheduled for Thanksgiving 1979.

Meanwhile, Polinsky has another flank under attack in a second lawsuit, this one filed by a disgruntled former associate who claims he has been shortchanged on partnership points in the Regency venture. He also claims he was promised a seat on the board of directors. Polinsky’s opponent in this suit owns one of the most famous names and highest-profile reputations in Atlantic City. Reese Palley is both a shrewd businessman and an interesting character. He has been a Boardwalk “merchant to the rich” for years, and when Resorts International opened its new casino last spring, Reese Palley promptly moved his high-class, high-priced art and jewelry shop right next door to the action. He also pulled off one of the city’s most talked-about real estate capers in March 1977 when he and a partner acquired the aged Marlborough-Blenheim Hotel and leased it to the Bally Corp., a Chicago-based gambling equipment manufacturer, which plans to build a $50-million hotel-casino on the site.

Palley’s partner in the Marlborough-Blenheim venture is Martin Blatt, Polinksy’s brother-in-law. Asked if his experiences with Regency and the resulting lawsuit have affected his relationship with Blatt, Palley told Corporate Report, “Not a bit. Martin Blatt is a dear friend and a partner. And you can print that in neon.” And what about Polinsky? “I have nothing to say,” Palley replied, “and, besides, I wouldn’t want to damage Jerry’s rights in the case.”

Of such is Jerrold Polinsky’s life in Atlantic City. Just what skills or funds he brings to his activities there is unclear. He has said that no Minnesota investors are involved, but a well connected Duluth businessman told Corporate Report that a half-dozen Duluth and Twin Cities people are backing the Atlantic City ventures. In Atlantic City, it seems clear that Rocky Aoki is willing to lay his bets alongside Polinsky’s. And one informed insider, when asked who might be staking the “Minnesota businessman’s” high rolls, whispered “Robert Guccione.” Coupled with information in the lawsuits, the whispered tip is enticing but hardly conclusive. Where Jerrold Polinsky is concerned, conclusions are as chancy as life in Atlantic City — where real life, quite possibly, has become a game.

Recommended Links:

Leave a Comment

Only registered members can post a comment , Login / Register Here

No Comments